According to a recent report, the United Kingdom tax authority has sent out tens of thousands of “nudge letters” to individuals suspected of owing or underreporting taxes on their crypto asset gains. This move reflects the increased tax scrutiny of cryptocurrency investors around the world over the past year.

UK Tax Regulator To Obtain User Data From Global Exchanges Starting 2026

In an October 17 report, Financial Times (FT) revealed that UK’s tax authority HM Revenue & Customs (HMRC) sent approximately 65,000 letters to digital asset holders suspected of evading taxes on their gains. These letters, officially known as “nudge letters,” are written to ask investors to correct their tax filings before formal investigations take place.

This figure, which represents a 134% increase from last year’s letters, was obtained by accounting firm UHH Hacker Young, which submitted a Freedom of Information Act request to the HMRC. Neela Chauhan, a partner at the accounting firm, revealed to Financial Times that the UK tax authority now receives transaction data directly from major exchanges in order to identify and confirm cases of crypto tax evasion.

Chauhan told FT:

The tax rules surrounding crypto are quite complex, and there’s now a volume of people who are trading in crypto and not understanding that even if they move from one coin to another, it triggers capital gains tax.

Furthermore, HMRC will also receive access to user information from global exchanges starting from January 2026 under the Organization for Economic Co-operation and Development (OECD)’s Crypto-Assets Reporting Framework (CARF). The UK tax office intends to collect data throughout 2026, with the first filing slated for May 31, 2027.

The UK crypto scene continues to expand, with digital asset regulation seemingly taking a better shape in the region. Recently, the Financial Conduct Authority lifted its four-year ban on crypto-linked exchange-traded notes (ETNs), allowing asset managers to offer indirect digital asset exposure to retail traders on the London Stock Exchange.

India Tax Authority Orders Probe Of Binance Traders

Crypto taxation has been ramping up all around the world, with other countries’ tax regulators also probing digital asset traders and digital asset holders suspected of avoiding tax.

As Bitcoinist reported, the Income Tax Department under the Central Board of Direct Taxes (CBDT) in India recently ordered a probe of 400 high-net-worth (HNI) individuals for hiding their crypto trades on the Binance exchange.

These investors are suspected of avoiding taxes on their digital asset gains between 2022-23 and 2024-25, while also failing to disclose their investments in various exchange wallets outside the country.

Related Reading: Major Japanese Banks Plan Joint Stablecoin Rollout By Year-End – Report

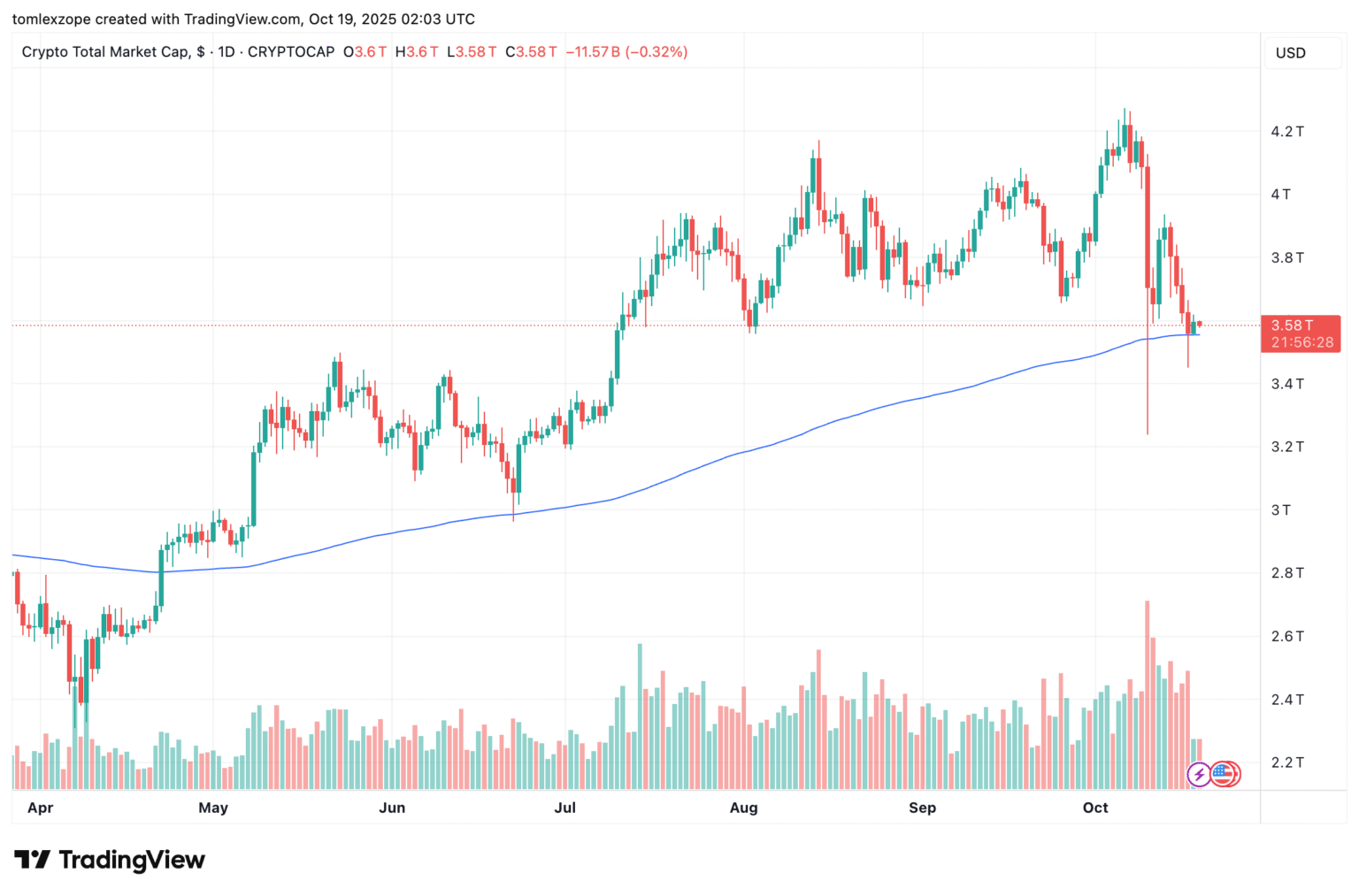

The total market cap on the daily timeframe | Source: TOTAL chart on TradingView

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.