Institutional demand for digital assets saw a significant uptick as investors digested news about the US Senate reaching a much-awaited deal that could soon end the 40-day government shutdown.

On Sunday, the US Senate advanced a procedural vote to end the government shutdown, with the final post-cloture vote expected to occur on Monday, according to the Senate’s schedule.

Cryptocurrency markets saw a rebound after the report. The Starknet (STRK) token rose over 43% as the day’s biggest winner, followed by the Trump-backed World Liberty Financial (WLFI) token, up 28% over the past 24 hours, according to CoinMarketCap data.

The nearing end of the government shutdown may reduce the “financial uncertainty” among global investors and fuel a crypto market recovery, Nicolai Sondergaard, research analyst at crypto intelligence platform Nansen, told Cointelegraph.

“For weeks, markets were effectively operating in the dark, key economic data releases, policy updates, and regulatory processes were all frozen during the shutdown.”

Once the government’s operations resume, investors can “price in real fundamentals rather than speculation,” as key federal agency-backed releases were canceled due to the shutdown, added Sondergaard.

Related: James Wynn goes ‘all-in’ on shorting Bitcoin after 12 liquidations in 12 hours

Institutions restart Ether accumulation fueled by the perspective of US government shutdown end

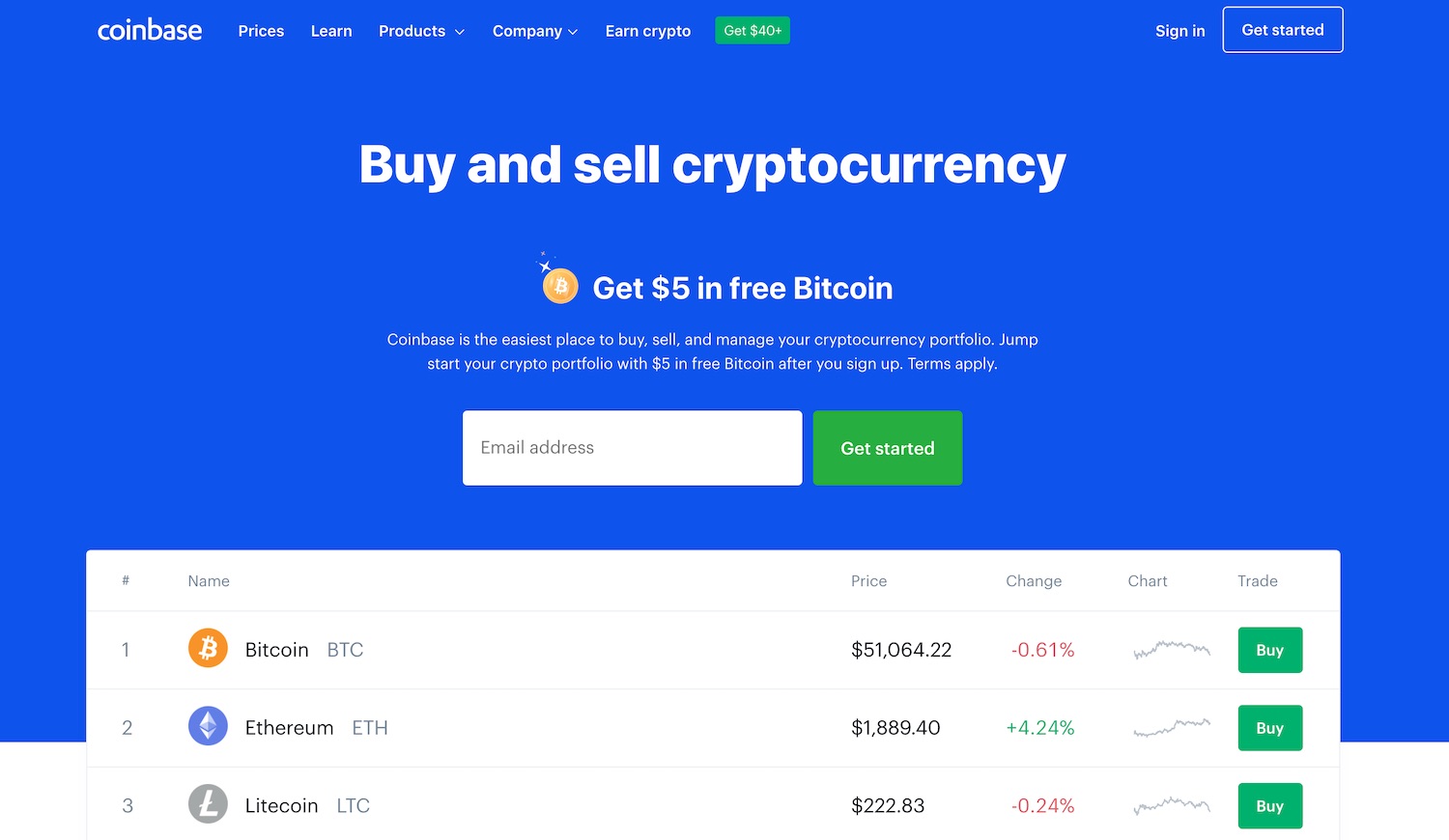

Following the news of the potential end of the 40-day government shutdown, institutional investors have restarted their Ether (ETH) accumulation based on the growing average spot order data.

Ethereum may be entering a period of “low-volatility accumulation” if Ether price manages to remain afloat above the $3,000 to $3,400 range, according to crypto intelligence platform CryptoQuant.

However, the broader market recovery will ultimately depend on the incoming Bitcoin (BTC) and Ether ETF inflows, which will ultimately determine whether this recovery will see “sustained institutional demand rather than just retail or short-term flows,” according to Nomura Group’s Laser Digital derivatives trading desk, in a report shared with Cointelegraph.

Related: Michael Saylor’s Strategy kickstarts November with $45M Bitcoin buy

Looming end of government shutdown raises hopes of altcoin ETF “floodgates”

In the wider crypto space, ETF analyst Nate Geraci saw the end of the shutdown as a positive development that will open the ETF floodgates.

“Government shutdown ending = spot crypto ETF floodgates opening,” wrote Geraci in a Monday X post, adding that this may also introduce the first spot XRP (XRP) ETF under the Securities Act of 1933.

This would make the 21Shares fund the first XRP exchange-traded product and fourth altcoin ETP launched under the Act of 1933. The spot Bitcoin and Ether ETFs were also approved under the same framework, but listed under the Securities Exchange Act of 1934, which requires exchange oversight.

At least 16 crypto ETF applications are currently awaiting approval, delayed by the US government shutdown, now in its 40th day.

Magazine: Sharplink exec shocked by level of BTC and ETH ETF hodling — Joseph Chalom