A sharp sell-off has pushed the Bitcoin price into a steep correction, and one of Wall Street’s most influential macro strategists says investors should welcome it. Fidelity’s Global Macro Director, Jurrien Timmer, frames the latest Bitcoin crash as a necessary purge for overheated risk assets—clearing out leverage, cooling speculation, and restoring market discipline. The billion-dollar wealth manager describes the downturn as a structural reset that ultimately reinforces Bitcoin’s long-term investment profile.

Bitcoin Price Crash Signals A Healthier Market Reset

Bitcoin has shed 11.8% over the past two weeks, and while that might trigger headlines of panic, according to Timmer, a closer look reveals a healthier market adjustment at work. In a recent post on X, he frames this ongoing Bitcoin price decline as a necessary correction rather than a crisis.

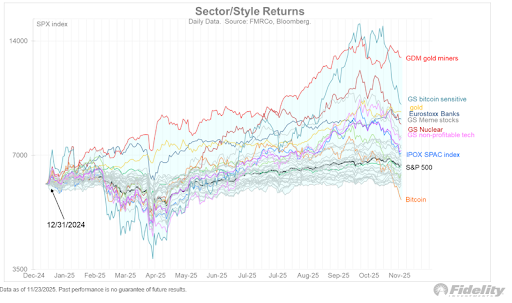

He points to a broad spectrum of speculative assets—including meme stocks, SPACs, unprofitable tech companies, recent IPOs, and equities highly sensitive to Bitcoin price—showing the same pattern: rapid gains through Q3 2025, followed by a synchronized pullback. Within this context, Bitcoin is simply adjusting its position, moving lower on the performance scale as the market sheds excess speculation.

Timmer frames this decline as an orderly unwinding of overextended leverage rather than a collapse in market structure. His chart shows stretched valuations normalizing, risk exposure being reassessed, and the broader capital stack recalibrating after months of momentum-driven activity. These shifts remove structural distortions, strengthen market integrity, and restore disciplined capital allocation—foundations for long-term stability.

The chart also highlights how the correction separates speculative noise from true fundamentals. As speculative excess retreats, Bitcoin’s price trajectory aligns more closely with adoption and real-world utility. Weakness in Bitcoin-sensitive equities reinforces this shift: the market is refining expectations, not abandoning the asset. Timmer presents this pullback as less a setback and more a course correction that positions Bitcoin for sustainable growth.

Correction Highlights Market Discipline

Even as the Bitcoin price drops to the lower end of the sector-return chart—well behind gold miners, equities, and thematic baskets—Timmer argues that its long-term network trajectory remains intact. The chart he posted shows a pattern consistent with past drawdowns that cleared excess leverage, slowed rapid inflows, and pulled the asset back toward its adoption curve.

He notes that while other sectors surged and unwound sharply through 2025, Bitcoin’s path stayed more disciplined. For Timmer, this is the key distinction: corrections act as rebalancing events, resetting supply and demand and flushing out fast-money activity.

In his framing, the crash is not a breakdown but a sanitation cycle—a broad risk repricing that removes speculative noise and restores order across overheated markets. Rather than a crisis, it becomes a detox that reinforces Bitcoin’s structural foundation and sets the stage for its next phase of maturation.

Featured image created with Dall.E, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.