Bitcoin’s (BTC) start-of-year recovery continued into the second week of January as the cryptocurrency made fresh 2026 highs above $96,000. The rally confirmed a new higher high structure, and traders are hopeful that a rally above $100,000 is the next target.

Key takeaways:

-

Bitcoin secured a daily close above $95,000, confirming a higher high and weakening near-term resistance.

-

Binance net taker volume briefly exceeded $500 million, coinciding with rising open interest and the lowest hourly funding rate since October 2025.

-

With limited resistance above $95,000, a technical rally to $103,500 is possible.

Key Bitcoin metrics indicate a rally is here to stay

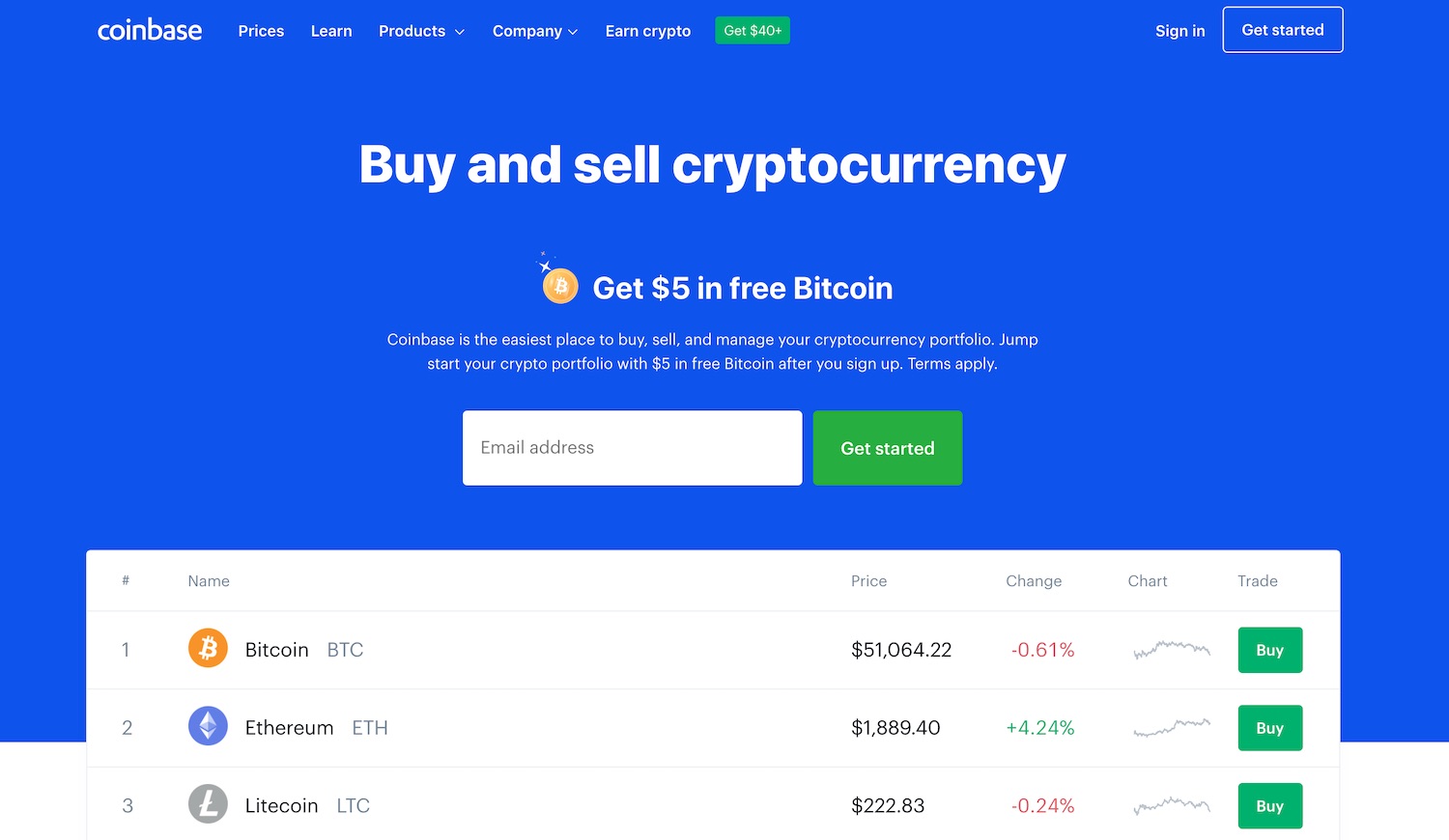

Onchain data shows Bitcoin’s rally gaining strength. The Coinbase Premium Index has gradually reset after sustained selling between Jan. 6 and Jan. 11. While the index remains net-negative, the pace of selling pressure has clearly slowed, suggesting reduced panic from US-based investors.

Additionally, the seven-day average Bitcoin inflow to Coinbase Advanced is running at roughly 2.5 times its baseline. Similar inflow spikes in the past have preceded price appreciation, tied to spot accumulation, OTC settlement, or ETF positioning rather than outright selling.

At the same time, stablecoin inflows remain muted. This points to a waiting phase from investors, and in past cycles, stablecoin liquidity has frequently lagged BTC inflows, but it can turn into a conditional bullish signal if follow-through demand emerges.

Derivatives data reinforces this view. Crypto analyst Amr Taha noted a sharp expansion in Binance net taker volume, with a single hourly candle exceeding $500 million in aggressive market buying.

Combined with rising open interest, this behavior has historically aligned with trend continuation rather than reversals. Similar conditions earlier this month preceded a rapid move toward $96,000.

Bitcoin’s hourly funding rate also hit its lowest level since October 17, 2025, reflecting crowded short exposure and cautious use of leverage. As funding normalized, the price rallied sharply, suggesting shorts were forced to unwind into strength.

Related: Spot flows drive Bitcoin surge as analysts tip $100K run next

Key price levels to watch for BTC

In the short-term, traders will continue to watch $100,000. However, from a technical standpoint, the next major supply zone sits higher between $103,300 and $107,500. Between $95,000 and $103,300, overhead resistance is notably thin, allowing room for price expansion if the momentum persists.

The broader market liquidity remains light across both spot and futures markets, leaving BTC vulnerable to sharp swings. The recent rally above $95,300 liquidated $270 millions in short positions, shifting the next meaningful liquidity cluster to the long side.

From a structural perspective, the $92,500 to $90,000 region also stands out on the lower end. A daily order block formed there following the rally, marking a potential zone where Bitcoin could establish its next higher low. Holding that area would strengthen the case for a sustained push above $100,000 before month-end.

Related: Bitcoin cools near $96.5K as markets shrug off US tariff uncertainty

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.