Retail investors captured about 20% of US stock trading volume in Q3 2025, the second-highest level ever recorded. At the same time, the crypto market is experiencing the opposite trend, with institutional capital dominating as retail participation declines.

This divide between equities and digital assets raises important questions about market maturity, volatility, and the future direction of both asset classes as 2026 approaches.

Sponsored

Sponsored

Stocks Go Retail While Crypto Turns Institutional

The rise in retail investor activity marks a major change in equity market structure. According to data shared by the Kobeissi Letter, individual investors reached their second-highest trading share in history during Q3 2025, nearing the peak of the Q1 2021 meme stock surge.

Before 2020, average retail participation was about 15% for several years. Thus, this makes the current 20% figure quite significant.

Retail participation has surpassed individual institutional categories. Long-only mutual funds and traditional hedge funds each accounted for about 15% of trading volume last quarter, or half their 2015 share. Furthermore, all fund categories, including quants, together made up just 31% in Q3.

“Retail investors are taking over the market at a historic pace,” The Kobeissi Letter stated.

Meanwhile, the crypto market now shows the reverse of the stock market’s composition. While retail investors fueled past bull runs, 2025 saw a clear shift to institutional dominance. JPMorgan, in its recent note, highlighted that retail participation in the market has fallen. According to the bank,

“Crypto is moving away from resembling a venture capital style ecosystem to a typical tradable macro asset class supported by institutional liquidity rather than retail speculation.”

Sponsored

Sponsored

It is worth noting that the crypto market’s drawdown has reduced demand for exchange-traded funds (ETFs) and put substantial pressure on digital asset treasury (DAT) firms. That said, analysts indicate that buying interest has slowed rather than disappeared.

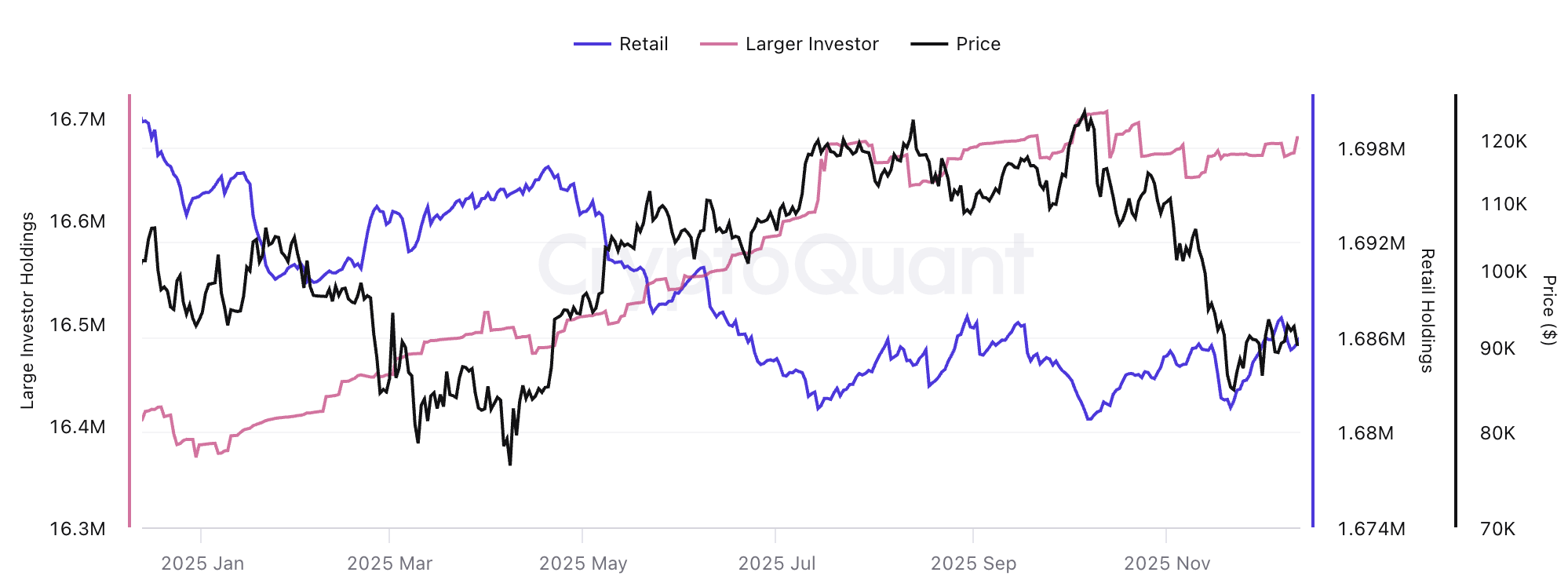

This dynamic is reflected in the growing gap between retail and institutional behavior. According to CryptoQuant data, institutional Bitcoin holdings continued to expand throughout 2025, while retail investors moved in the opposite direction.

Why This Contrast Matters

The market changes matter beyond participation rates. High retail activity in stock markets typically reflects a sentiment-driven environment where price action is increasingly influenced by short-term narratives, momentum chasing, and crowd behavior. When individual investors dominate trading, markets tend to become more reactive.

On the other hand, crypto analysts view institutional dominance as a sign of growing maturity and future stability. More institutional capital means deeper liquidity, more stable pricing, and (in theory) less volatility. Large institutions usually have longer time horizons and better risk management, which could allow for steadier price growth instead of wild swings.

Still, expectations for crypto remain cautious. Barclays projects 2026 as a down year for crypto, noting that in the absence of major catalysts, structural growth appears limited. While the US political climate has become more crypto-friendly this year, Barclays believes this shift has already been priced in by the market.

Thus, the divergence between equities and crypto highlights a structural shift in how risk is being expressed across markets. While rising retail participation is making stock trading more sentiment-driven, crypto’s growing institutional base points to increased maturity but more subdued momentum. Whether these differences are temporary or mark a lasting shift as 2026 nears remains to be seen.